The recent events of the financial market have discouraged

many investors from putting their money in equities. Investment dollars are

leaving the equity market in droves towards less risky government bonds. Despite

the many perils noted by market watchers and investment advisors, this analysis

presents a strong case for investing in equities for the long-term. The

Canadian equity market as represented by the S&P TSX has performed

impressively over the last almost three decades. As illustrated in Exhibit 1, while

the herd mentality of investors has resulted in a “crash and burn” outcome for

the TSX, the market returns have nonetheless been staggering over the long-term

with an accumulated return of 1106% over the 36 year period from 1976-2012

(YTD). This translates to a CAGR of 7.16% implying that if an individual

invested $100,000 in an index fund in 1976 that perfectly tracks the TSX, s/he

would have funds in excess of $1.2 million by 2012.

Exhibit 1

So how should one

navigate investments in the future?

The crash and burn scenario has been a norm in the Canadian

financial market. However, the severity of drawdown in the market has

experienced an uptick in the recent years. As shown in Exhibit 2, the long-term

gain in the market has been tapered by periodic corrections. The typical cycle in the Canadian stock

market has been a 4:1 cycle where the market is in the positive gaining

momentum for a period of four years and then corrects in the fifth year

dropping a significant percentage point.

Exhibit 2

The severity of negative events has increased significantly

post 2001. Exhibit 3 shows that whereas the quantum associated with negative

events preceding the dot-com boom experienced on average an 8% drawdown, in the

post 2001 world the average drawdown has gone up three folds to 25%.

Exhibit 3

It is expected that due to factors such as increased

globalization, financial product complexity, increased participation in the

financial markets etc, the new world order of sustained levels of high

volatility will continue. For example, increased globalization has meant that

now a number of global events affect the Canadian market exogenously. Thus, it

is expected that the crash and burn scenario will continue to take place on

average every four years. The markets will continue to show resilience, dusting

off its shoulder and carrying on for 4 years before getting hammered again.

For investors with a long-term investment horizon, the

equity market in Canada will provide an attractive return that will be well in

excess of risk free investment. As illustrated in Exhibit 4, a $100,000

investment in the equities market today will easily exceed the risk free return

in the long-run. There are four scenarios presented in Exhibit 4: risk free,

optimist, realistic and pessimistic. If an investor puts aside $100,000 in risk

free investments, he can expect to get almost $380,000 in 35 years. Even in the

most pessimistic of outcomes for the Canadian equity market, where the market

experiences 15% drop in value in the first 5 years increasing by 6 percentage

point every 5 year, such that by year 32, the market drops by 45%, the equity

market will still beat the risk free investment by providing almost twice the

returns. It should be noted that in the optimistic scenario the market

continues to experience its natural cycle, albeit less severe, dropping by 15%

in the fifth year and increasing by 2 percentage points henceforth every fifth

year. Under the optimistic scenario, an investment of $100,000 of principal in

year 1 will yield almost $1.7 million by year 35 which is 4.4 times higher than

risk free investment.

Exhibit 4

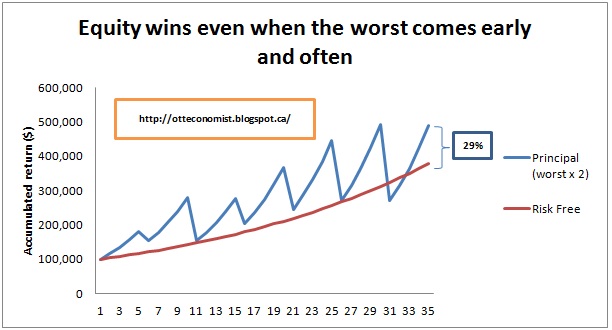

The next exhibit is a nail in the coffin for a decision

between a risk free investment and investment in market portfolio. This

scenario contemplates an equities market that performs twice as worst as the

most pessimistic scenario in Exhibit 4.

The risk free investment continues to earn a 4% return over the 35 year period

but the equities market, with its jagged edge route than previously considered still

ekes out a premium of 29% over the risk free return. It is important to gain a

better appreciation of what is in store for the equities market in Exhibit 5. Under this scenario, the

equities market will gain 16% during the four years up-swing cycles in the

market, dropping by 15% in the fifth year, 45% in year 10, 27% in year 15, 33%

in year 21, 39% in year 25 and finally 45% in year 30.

Exhibit 5

Exhibit 6 Main Assumptions

Assumption

|

Detail

|

Risk free rate

|

Risk free rate of 4% is assumed over the 35 year period.

|

Stock market cycle

|

It is assumed that the equity markets follow a cycle where for 4 years

the annual returns are 16% annually and then the market goes down by a

certain percentage point depending on the scenario

|

Optimistic scenario

|

Market goes up by 16% annually in the first four years,

then drops by 15% in year 5, then goes up by 16% for subsequent 4 years and

drops by 17% in year 10. This 16% up and 2% incremental drawdown every five

year continues on until year 35.

|

Realistic scenario

|

Market goes up by 16% annually in the first four years, then drops by

15% in year 5, then goes up by 16% for subsequent 4 years and drops by 19% in

year 10. This 16% up and 4% incremental drawdown every five year continues on

until year 35.

|

Pessimistic scenario

|

Market goes up by 16% annually in the first four years,

then drops by 15% in year 5, then goes up by 16% for subsequent 4 years and

drops by 21% in year 10. This 16% up and 6% incremental drawdown every five

year continues on until year 35.

|

Worst x 2 scenario

|

Market goes up by 16% annually in the first four years, then drops by

15% in year 5, then goes up by 16% for subsequent 4 years and drops by 45% in

year 10. The market then recovers at 16% annually for the next 4 years and

then drops by 27% in year 15, dropping by 6% in every next 5 year cycle.

Finally the market drops by 45% again in year 30.

|

Stock market investment decision

|

It is assumed that investors either have a highly

diversified portfolio of investments that has a Beta of close to 1 or that

investors are invested in ETFs that closely tracks the performance of the

S&P TSX. This assumption is reasonable considering that most industry

reports have shown that investment managers at hedge funds and mutual funds

have largely been unable to beat the market performance. This combined with

the fact that investment products such as ETFs offer a low cost solution to

investing in the market means that it is highly likely that most equity

investors will experience the returns and cycles profiles in this analysis.

|

Really well put together. Love the charts. Let's talk. Siyam

ReplyDelete